than a five-year term and former Chief Executive Officers of AIG cannot serve as directors. No individual may stand for election as a director after reaching the age of 75, and the Board may only waive this requirement for a one-year period if, on the recommendation of the Nominating and Corporate Governance Committee, it determines such waiver to be in the best interests of AIG.

Director and Board Accountability and Evaluations. The AIG Board believes that self-evaluations of the Board, the standing Committees of the Boardcommittees and individual directors are important elementsdirectors. Past self-evaluations have informed the Board’s consideration of corporate governance. PursuantBoard roles, opportunities to AIG’s Corporate Governance Guidelines,increase the Board’s effectiveness and priorities, refreshment objectives, including composition and diversity, and director succession planning.

Board acting through the NominatingMeetings and Corporate Governance Committee and under the general oversight of the Chairman, conducts an annual self-evaluation and evaluation of each member of the Board, and each standing Committee conducts an annual self-evaluation.Attendance in 2022

The Board considers | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

91% Average attendance by directors at the 10 Board meetings during 2022 | | 10 Board meetings | | 27 Committee meetings | | 90% Average attendance by directors at Board and committee meetings |

| | | | | | |

For health reasons, one director, attendance at Board and Committee meetings an essential duty of a director. As a result, AIG’s Corporate Governance Guidelines also provide that any director who, for two consecutive calendar years, attendsMr. Motamed, attended fewer than 75 percent of the total regular meetings of the Board and the meetings of all Committees ofcommittees on which such director is a voting member, will not be nominated for re-election at the annual meeting in the next succeeding calendar year, absent special circumstances that may be taken into account byhe served during 2022. As previously disclosed and as discussed above, Mr. Motamed retired from the Board and the Nominating and Corporate Governance Committeefor health reasons in making its recommendations to the Board. As described below, all director nominees satisfied this attendance threshold.January 2023.

Oversight of Risk Management

The Board oversees the management of risk (including, for example, risks related to market conditions, reserves, catastrophes, investments, liquidity, capital and cybersecurity) through the complementary functioning of the Risk and Capital Committee and the Audit Committee and interaction with other Committees of the Board. The Risk and Capital Committee oversees AIG’s Enterprise Risk Management (ERM) as one of its core responsibilities and reviews AIG’s significant risk assessment and risk management policies. The Audit Committee also discusses the guidelines and policies governing the process by which AIG assesses and manages risk and considers AIG’s major risk exposures and how they are monitored and controlled. The Chairs of the two Committees then coordinate with each other and the Chairs of the other Committees of the Board to help ensure that each Committee has received the information that it needs to carry out its responsibilities with respect to risk management. Both the Risk and Capital Committee and the Audit Committee report to the Board with respect to any notable risk management issues. The Compensation and Management Resources Committee, in conjunction with AIG’s Chief Risk Officer, is responsible for reviewing the relationship between AIG’s risk management policies and practices and the incentive compensation arrangements applicable to senior executives. For further information regarding the annual risk assessment of compensation plans, see “Report of the Compensation and Management Resources Committee.”

Board Meetings and Attendance

There were 14 meetings of the Board during 2017. The independent directors meet in regularly scheduled executive session,sessions without the Chief Executive Officer present,management, in conjunction with each regularly scheduled Board meeting. Mr. Steenland, asand committee meetings. These sessions are led by the Lead Independent Chairman of the Board, presided at the executive sessions. For 2016Director and 2017, all of the directors attended at least 75 percent of the aggregate of all meetings of thecommittee chairs following Board and committee meetings, respectively. The Board met in executive session without management present during 8 of the Committees of the Board on which they served.its 10 meetings in 2022.

Pursuant toUnder the Corporate Governance Guidelines, all directors are generally expected to attend the Annual Meeting. Allannual meeting. Each of the directors standingwho stood for election at the 20172022 Annual Meeting attendedparticipated in that meeting.

AIG 2023 PROXY STATEMENT17

Corporate Governance Areas of Board Oversight

Areas of Board Oversight

The Board fulfills its oversight role with respect to AIG’s strategic priorities through year-round discussions and presentations covering Company-wide and business unit-specific updates. The Board also oversees other key areas, including management succession planning, human capital management (including DEI), sustainability (including climate-related issues), corporate social responsibility, government affairs, risk management and cybersecurity.

Board Oversight of Risk Management

We consider risk management an integral part of our business strategy and a key element of our approach to corporate governance. We have an integrated process for managing risks throughout our organization in accordance with our firm-wide risk appetite. Our Board has oversight responsibility for the 2017management of risk.

Management has the day-to-day responsibility for assessing and managing AIG's risk exposure, and the Board and its committees provide oversight in connection with those efforts, with particular focus on reviewing AIG's most significant existing and emerging risks.

| | | | | | | | | | | |

| Committee Risk Oversight Responsibilities | | |

| | | |

| | | |

| Audit Committee | nEvaluates and oversees the guidelines and policies governing AIG’s risk assessment and management processes relating to financial reporting as well as the risk control framework nAIG’s Chief Risk Officer periodically reports to the Audit Committee | | The Board oversees the management of risk, including those related to market conditions, reserves, catastrophes, investments, liquidity, capital, climate and cybersecurity, through the complementary functioning of the committees

The Board, directly or through its committees, oversees the Company’s risk management policies and practices, including the Company’s risk appetite statement, and regularly discusses risk-related issues |

| | |

| | |

| Risk and Capital Committee | nAssists the Board in overseeing and reviewing information regarding AIG’s Enterprise Risk Management (ERM) practices, including the significant policies, procedures, and practices employed to manage liquidity, credit, market, operational and insurance risks nAIG’s Chief Risk Officer periodically reports to the Risk and Capital Committee, including with regard to emerging risks and climate-related risks | |

| | |

| | |

| Compensation and Management Resources Committee | nOversees the assessment of the risks related to AIG’s compensation policies and programs nAIG’s Chief Risk Officer periodically reports to the Compensation and Management Resources Committee on the relationship between AIG’s risk management policies and practices and the incentive compensation arrangements applicable to senior executives | |

| | |

| | |

| Nominating and Corporate Governance Committee | nOversees and reports to the Board on risks related to director independence and related party transactions, public policy and lobbying activities, and sustainability-related issues | |

| | | |

18AIG 2023 PROXY STATEMENT

Corporate Governance Areas of Board Oversight

Board Oversight of Cybersecurity

AIG, like other global companies, continues to witness the increased sophistication and activities of unauthorized parties attempting cyber and other computer-related penetrations such as "denial of service" attacks, phishing, untargeted but sophisticated and automated attacks, and other disruptive software in an effort to compromise systems, networks and obtain sensitive information. Cybersecurity risks may also derive from unintentional human error or intentional malice on the part of AIG employees or third parties who have authorized access to AIG's systems or information. AIG requires its employees to complete periodic training on cyber education.

The Board is briefed by management, including the Chief Information Security Officer, the Chief Technology Officer and the Chief Risk Officer, on the risks related to cybersecurity matters. Cybersecurity risks reviewed with the Board include threats, events, incidents, the impact on our technological operations and infrastructure and the resilience of our systems. The Board is informed of the Company's policies and procedures for assessments and testing, monitoring, reporting and managing cyber threats and incidents, as well as the capabilities and talent management of personnel in these functions, along with ongoing efforts to improve the cybersecurity infrastructure.

AIG 2023 PROXY STATEMENT19

Corporate Governance Areas of Board Oversight

Board Oversight of Human Capital Management

We believe that our people are our greatest strength. To this end, we place significant focus on human capital management; namely, retaining, attracting and developing high caliber talent committed to our journey to becoming a top performing company and fostering an inclusive environment in which we actively seek and embrace diverse thinking.

The CMRC oversees AIG’s initiatives and progress on various human capital management efforts, and management regularly reports to the CMRC on our various human capital management initiatives and metrics, including DEI. We believe that we foster a constructive and healthy work environment for our employees.

Management Succession Planning

The Board recognizes the importance of management succession planning. To this end, under our Corporate Governance Guidelines and the CMRC’s charter, our Chief Executive Officer presents to the CMRC, a management succession plan, which includes readiness assessments and career development opportunities. We are focused on raising the profile of high performing employees and assisting our top leaders to develop skills, behaviors and leadership acumen to continue the successful transformation of the business.

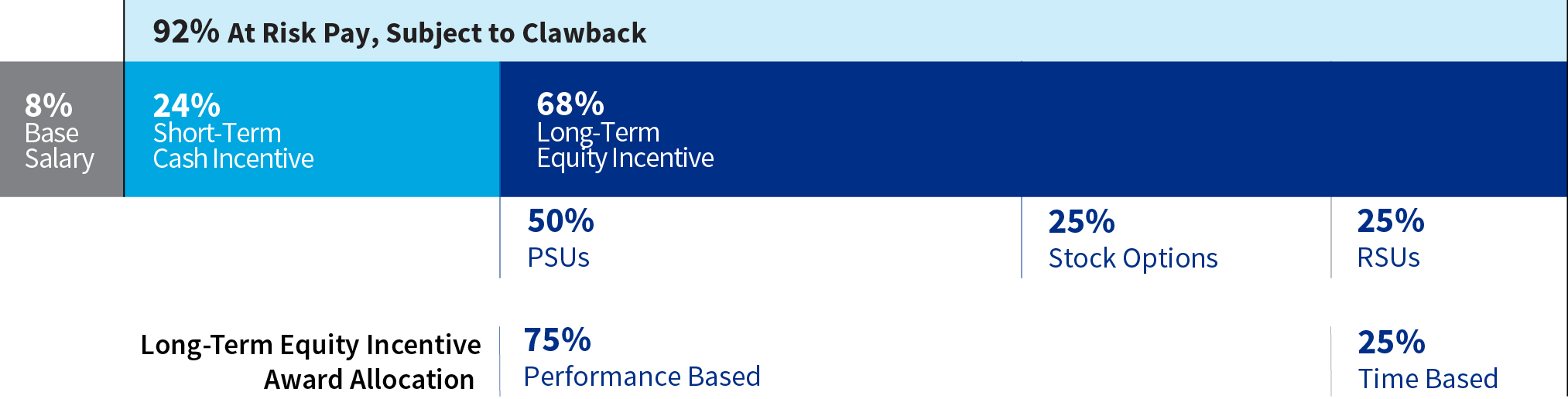

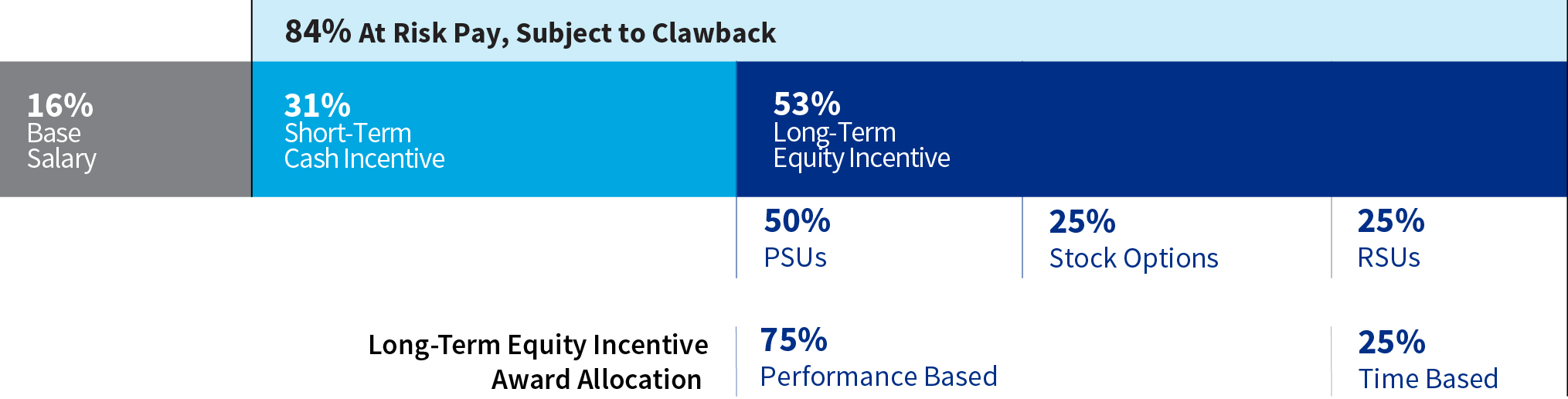

Competitive Compensation and Benefits

Under the oversight of the CMRC, the Company strives to align compensation with individual and company performance and provide the appropriate market-competitive incentives to retain, attract and motivate employees to achieve outstanding results.

Management and the CMRC engage the services of third-party compensation consultants to help monitor the competitiveness of our incentive programs. We have a performance-driven compensation structure that consists of base salary and, for eligible employees, short- and long-term incentives. We also offer comprehensive benefits to support the health, wellness, work-life balance and retirement preparedness/savings needs of our employees, including subsidized health care plans, life and disability insurance, wellness and mental health benefits, legal assistance plan, paid time off, paid volunteer time off, 2:1 matching grants for eligible charitable donations, parental and bonding leave and both matching and Company 401(k) contributions for eligible employees.

Talent Development

We are committed to equipping our employees with the skills and capabilities to be successful and to contribute to AIG. We do this by giving our employees access to meaningful tools and resources to assist in their professional development, including through courses and training that help employees build a strong foundation of core skills such as communication, collaboration, change agility and problem solving. In addition, AIG believes managers and leaders are critical in developing AIG’s talent for organizational success. To that end, we use distinct leadership assessment tools, including 360-degree feedback, which help to develop self-awareness and build personalized leadership development goals. With respect to succession planning, we use a globally consistent streamlined process, which helps identify a pipeline of talent for positions at all levels of the organization, and the actions needed to support their development. In 2022, 36 percent of all our open positions were filled with internal talent.

Health and Wellness

We prioritize the health and safety of our employees. For example, nearly every country in which we operate has an employee assistance program that provides employees with confidential counselling, mental health resources and information to help employees and their dependents through times of stress and anxiety. In addition, Our Compassionate Colleagues Fund has helped more than 730 employees overcome serious financial hardships and disasters.

Diversity, Equity and Inclusion

We are committed to creating an inclusive workplace focused on retaining, attracting and developing diverse talent that fosters a culture of belonging for all employees. AIG’s Executive Vice President, Chief Human Resources & Diversity Officer coordinates AIG’s efforts in making meaningful strides as it relates to DEI. We published our consolidated 2019, 2020 and 2021 EEO-1 reports on our website to promote transparency about our progress in increasing the diversity of our workforce.

20AIG 2023 PROXY STATEMENT

Corporate Governance Areas of Board Oversight

Board Oversight of Sustainability Matters

| | | | | |

AIG assesses the potential impact from climate-related issues on our business, strategy and financial planning over short-, medium- and long-term time horizons. AIG considers abiding by and upholding sustainability principles as a part of our strategic priority to become a top performing company and promote value creation; to help protect businesses, families and individuals against the impacts of unexpected losses; to advance the discipline of reducing uncertainty in the world; and to further establish our leadership in insurance, investments and business. AIG considers both direct physical impacts and indirect effects that may emerge through transition risks, particularly those driven by new legal and regulatory requirements. We also consider evolving investor, client and broker expectations. AIG’s four sustainability priorities (community resilience, financial security, sustainable operations and sustainable investing) align with our core strategic priorities and focus on future proofing communities. | AIG’s Sustainability Priorities nCommunity resilience nFinancial security nSustainable operations nSustainable investing |

The NCGC oversees and reports to the Board as necessary with respect to sustainability, corporate social responsibility and lobbying and public policy matters.

Additional Information Available in AIG’s ESG Reports

For more information on how AIG identifies and addresses sustainability, DEI and governance topics, please see AIG’s 2021 ESG Report issued in May 2022, which can be found on AIG's website at www.aig.com. This report showcases various ESG efforts across the Company and how we see them as strategically important building blocks to support a cleaner and healthier environment, to uphold our commitment to supporting the communities where we live and work and to make these efforts accountable, scalable and repeatable. AIG will be releasing its 2022 ESG Report later this year.

AIG 2023 PROXY STATEMENT21

Corporate Governance Board Committees

Board Committees

The Board has four committees: Audit, Compensation and Management Resources, Nominating and Corporate Governance, and Risk and Capital. Each of these committees is composed exclusively of independent directors. Committee meetings are generally held in conjunction with scheduled Board meetings and additional meetings are held as needed, including meetings of the Audit Committee, which are also held to review quarterly and year-end earnings reports.

Each committee operates under a written charter – all of which are available on our website (www.aig.com). Each charter is reviewed annually by the respective committee. Under those charters, each committee has the authority to retain independent advisors to assist in the performance of their respective responsibilities. Each committee reviews reports from senior management and reports its actions to, and discusses its recommendations with, the full Board.

All committee chairs are appointed at least annually by the Board. The Corporate Governance Guidelines provide that a committee chair should generally serve for not less than three consecutive years and not more than five years.

The tables below reflect the current membership and the number of meetings held in 2022 for each committee. Mr. Steenland, who is retiring at the Annual Meeting, had served as an ex officio, non-voting member of each committee while he was Lead Independent Director. Mr. Zaffino does not serve on any of the committees. Ms. Bergamaschi, Ms. Murphy and Ms. Wittman will be assigned to committees when the Board assigns directors to committees and chair positions following the Annual Meeting.

Audit Committee

| | | | | |

MEMBERS Peter R. Porrino, Chair W. Don Cornwell Linda A. Mills John G. Rice

7 MEETINGS HELD IN 2022 | PRIMARY RESPONSIBILITIES nAssists the Board in its oversight of AIG’s financial statements, including internal control over financial reporting nReviews and discusses with senior management the guidelines and policies by which AIG assesses and manages the Company's exposures to risk nCoordinates with the Chair of the Risk and Capital Committee to help each committee receive the information it needs to carry out its responsibilities with respect to oversight of risk assessment and risk management nAssists the Board in its oversight of the qualifications, independence and performance of AIG’s independent registered public accounting firm, including responsibility for the appointment, compensation, retention and oversight of the firm's work nAssists the Board in its oversight of the performance of AIG’s internal audit function, including responsibility for the appointment, replacement, reassignment or dismissal of, and being involved in the performance reviews of, AIG’s chief internal auditor nAssists the Board in its oversight of AIG’s compliance with regulatory requirements, including reviewing periodically with management any significant legal, compliance and regulatory matters that have arisen or that may have a material impact on AIG’s business, financial statements or compliance policies, AIG’s relations with regulators and governmental agencies and any material reports or inquiries from regulators and government agencies nApproves regular, periodic cash dividends on AIG common stock and preferred stock consistent with Board-approved dividend policies and with support from the Risk and Capital Committee to confirm the adequacy of AIG’s capital and liquidity |

|

The Board has determined, on the recommendation of the NCGC, that (i) each member of the Audit Committee (Messrs. Porrino, Cornwell and Rice, and Ms. Mills) is financially literate and has accounting or related financial management expertise under the NYSE's listing standards and (ii) Messrs. Porrino, Cornwell and Rice are “audit committee financial experts” as that term is defined in the Securities and Exchange Commission's (SEC) rules.

22AIG 2023 PROXY STATEMENT

Corporate Governance Board Committees

Compensation and Management Resources Committee

| | | | | |

MEMBERS* Linda A. Mills, Chair William G. Jurgensen Therese M. Vaughan

8 MEETINGS HELD IN 2022 | PRIMARY RESPONSIBILITIES nOversees AIG’s compensation programs generally and makes recommendations to the Board regarding AIG’s general compensation philosophy nReviews and approves incentive award performance metrics and goals relevant to the compensation of AIG’s CEO, evaluates the CEO’s performance and determines and approves the compensation awarded to the CEO (subject to ratification or approval by the Board) nReviews and approves the incentive award performance metrics relevant to the compensation of the other senior executives under its purview and, based on the recommendation of the CEO, approves their compensation nReviews reports about the compensation of other key corporate officers of AIG, as the CMRC deems appropriate nOversees and reports to the Board, at least annually, on AIG’s management development and succession planning programs nOversees the assessment of the risks related to AIG’s compensation policies and programs nReviews periodic updates from management on initiatives and progress in the area of human capital, including DEI and employee engagement surveys nEngages the services of an independent compensation consultant to advise on executive compensation matters |

| *Throughout 2022, the CMRC was comprised of four independent directors until the retirement of Mr. Motamed, effective January 23, 2023. |

The CMRC may delegate its authority to subcommittees or the CMRC chair when it deems it appropriate and in the best interests of AIG. The CMRC may delegate to one or more executive officers the authority to make grants to any non-executive officer under AIG’s equity compensation plans as the CMRC deems appropriate and in accordance with the terms of such plans.

Compensation and Management Resources Committee Interlocks and Insider Participation

The Board has determined, on the recommendation of the NCGC, that all members of the CMRC in 2022 are independent under both the NYSE listing standards and applicable SEC rules. Further, no member of the CMRC in 2022 has ever been an officer or employee of AIG or had a relationship with AIG requiring disclosure as a related person transaction under SEC rules. No executive officer of AIG is, or was during 2022, a member of the compensation committee or board of another company, one of whose executive officers has been a member of the AIG Board or the CMRC.

AIG 2023 PROXY STATEMENT23

Corporate Governance Board Committees

Nominating and Corporate Governance Committee

| | | | | |

MEMBERS* John Rice, Chair James Cole, Jr. W. Don Cornwell

7 MEETINGS HELD IN 2022 | PRIMARY RESPONSIBILITIES nIdentifies individuals qualified to become Board members, consistent with criteria approved by the Board and recommends these individuals to the Board for nomination, election or appointment as members of the Board and committees nConsiders board refreshment in light of various factors, including potential director departures, the Board’s mix and interplay of skills, experience and attributes, including diversity, and individual director performance nOversees the evaluation of the Board, committees and Lead Independent Director nPeriodically reviews and makes recommendations to the Board regarding the form and amount of independent director compensation nReviews and reports to the Board with respect to (1) AIG’s position, policies, practices and reporting with respect to sustainability; (2) current and emerging corporate social responsibility issues of significance to AIG; (3) public policy issues of significance to AIG; and (4) AIG’s relationships with public interest groups, legislatures, government agencies, as well as AIG stakeholders, and how those constituencies view AIG as those relationships relate to issues of public policy and social responsibility |

| *Throughout 2022, the NCGC was comprised of four independent directors until the retirement of Mr. Motamed, effective January 23, 2023. |

Risk and Capital Committee

| | | | | |

MEMBERS William G. Jurgensen, Chair James Cole, Jr. Peter R. Porrino Therese M. Vaughan

5 MEETINGS HELD IN 2022 | PRIMARY RESPONSIBILITIES nAssists the Board in overseeing and reviewing information regarding AIG’s ERM practices, including the significant policies, procedures and practices employed to manage liquidity risk, credit risk, market risk, operational risk and insurance risk nReceives regular updates from the Chief Risk Officer on ERM matters nReviews and makes recommendations to the Board with respect to AIG’s financial and investment policies nApproves issuances, investments, dispositions and other transactions and matters as authorized by the Board nAdvises the Audit Committee with respect to AIG’s capital and liquidity position to support the Audit Committee’s approval of regular, periodic cash dividends on AIG common and preferred stock nCoordinates with the chairs of the CMRC and Audit Committee to help each committee receive the information it needs to carry out its responsibilities with respect to risk assessment and risk management |

|

24AIG 2023 PROXY STATEMENT

Corporate Governance Compensation of Directors

Compensation of Directors

| | | | | |

Highlights of our Director Compensation Program | nNo fees for Board meeting attendance nEmphasis on equity, aligning director interests with shareholders nFormulaic annual equity grants to support independence nBenchmarking against peers with advice from independent compensation consultant nNo compensation is payable to non-independent directors for their service as directors nRobust director stock ownership guidelines |

We use a combination of cash and deferred stock-based awards to retain and attract qualified candidates to serve as independent directors. In setting director compensation, the NCGC considers the significant amount of time that members of the Board spend in fulfilling their duties to AIG, as well as the diverse and complementary skills, experience and attributes of our directors. The following table describes the compensation structure for AIG’s independent directors in 2022.

2022 Compensation Structure for Independent Directors

| | | | | |

| Base Annual Retainer | ($) |

| Cash Retainer | 125,000 | |

| Deferred Stock Units (DSUs) Award | 185,000 | |

| Annual Lead Independent Director Cash Retainer | 260,000 | |

| Annual Committee Chair Cash Retainers |

|

| Audit Committee | 40,000 | |

| Risk and Capital Committee | 40,000 | |

| Compensation and Management Resources Committee | 30,000 | |

| Nominating and Corporate Governance Committee | 20,000 | |

The annual cash retainer of $125,000 and any cash retainers due for service as the Lead Independent Director or as a committee chair are payable in four equal installments on the first business day of each quarter in arrears of service for the preceding quarter. The annual grant of $185,000 in the form of DSUs is made for prospective service and granted at the time of AIG’s Annual Meeting for the upcoming one-year term. Unless an independent director has elected to defer his or her DSUs (discussed below), the DSUs are delivered on the last trading day of the month in which the independent director’s service on the Board ends and are settled in shares of AIG common stock on a one-for-one basis. Each DSU includes dividend equivalent rights that entitle the independent director to a quarterly payment, in the form of additional DSUs, equal to the amount of any regular quarterly dividend that would have been paid by AIG if the shares of AIG common stock underlying the DSUs had been outstanding at that time.

Independent directors are also eligible for the AIG Matching Grants Program, through which AIG provides a two-for-one match on charitable donations in an amount of up to $10,000 per director annually (the same terms and conditions that apply to AIG employees).

Annually (or upon initial appointment to the Board), independent directors may elect to receive their base annual, Lead Independent Director and committee chair cash retainers, as applicable, in the form of DSUs. The number of DSUs granted is based on the closing sale price of AIG common stock on the date the cash retainer would otherwise be payable.

Under AIG’s director stock ownership guidelines, independent directors are required to retain any shares of AIG common stock received as a result of the exercise, vesting or settlement of any stock option or DSU granted by AIG until such time as they own shares of AIG common stock (including DSUs) with a value equal to at least five times the base annual retainer.

AIG’s Insider Trading Policy prohibits directors from engaging in hedging transactions with respect to any AIG securities, including by trading in any derivative security relating to AIG’s securities. In particular, other than pursuant to an AIG compensation or benefit plan or dividend distribution, directors may not acquire, write or otherwise enter into an instrument that has a value determined by reference to AIG securities, whether or not the instrument is issued by AIG. Examples include put and call options, forward contracts, collars and equity swaps relating to AIG securities. In addition, AIG’s Insider Trading Policy prohibits directors from pledging AIG securities and none of AIG’s directors have pledged any AIG securities.

AIG 2023 PROXY STATEMENT25

Corporate Governance Compensation of Directors

The following table contains information with respect to the compensation of the individuals who served as independent directors of AIG for all or part of 2022.

2022 Independent Director Compensation

| | | | | | | | | | | | | | |

Independent Directors

During 2022 | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | All Other Compensation ($)(4) | Total ($) |

| Paola Bergamaschi | $10,530 | | $81,588 | | $0 | | $92,118 | |

| James Cole, Jr. | $125,000 | | $184,973 | | $0 | | $309,973 | |

| W. Don Cornwell | $125,000 | | $184,973 | | $10,000 | | $319,973 | |

John H. Fitzpatrick(5) | $45,330 | | $0 | | $0 | | $45,330 | |

| William G. Jurgensen | $165,000 | | $184,973 | | $10,000 | | $359,973 | |

Christopher S. Lynch(5) | $52,583 | | $0 | | $93,550 | | $146,133 | |

| Linda A. Mills | $155,000 | | $184,973 | | $10,000 | | $349,973 | |

| Thomas F. Motamed | $125,000 | | $184,973 | | $0 | | $309,973 | |

| Peter R. Porrino | $165,000 | | $184,973 | | $0 | | $349,973 | |

| John G. Rice | $111,761 | | $28,337 | | $0 | | $140,098 | |

Amy L. Schioldager(5) | $45,330 | | $0 | | $93,550 | | $138,880 | |

| Douglas M. Steenland | $385,000 | | $184,973 | | $0 | | $569,973 | |

| Therese M. Vaughan | $125,000 | | $184,973 | | $0 | | $309,973 | |

(1)This column represents annual retainer fees, Lead Independent Director retainer fees and committee chair retainer fees, as applicable. For Ms. Bergamaschi, the amount includes a prorated Board retainer fee for her service as a director upon appointment to the Board of Directors, effective December 1, 2022. For Mr. Fitzpatrick, the amount includes a prorated Board retainer fee for his service as a director until the date of the 2022 Annual Meeting, and does not include $2,024,694.72, which represents the value of shares of AIG common stock delivered when he ceased to be a member of the Board as of the 2022 Annual Meeting in accordance with the terms of the DSUs previously granted. For Mr. Lynch, the amount includes prorated annual retainer fees for his service as director and as Chair of the NCGC until the date of the 2022 Annual Meeting. For Mr. Rice, the amount includes a prorated Board retainer fee for his service as a director upon appointment to the Board, effective March 17, 2022, and a prorated committee chair retainer fee for his service as Chair of the NCGC, effective upon his appointment to such position on May 11, 2022. For Ms. Schioldager, the amount includes a prorated Board retainer fee for her service as a director until the date of the 2022 Annual Meeting.

(2)This column represents the grant date fair value of DSUs granted in 2022 to independent directors determined in accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) Topic 718, based on the closing sale price of AIG common stock on the date of grant.

(3)At December 31, 2022, directors had outstanding stock awards as follows: (i) Paola Bergamaschi — 1,293; (ii) James Cole, Jr. — 7,612; (iii) W. Don Cornwell — 39,448; (iv) John H. Fitzpatrick — 34,504; (v) William G. Jurgensen — 34,137; (vi) Christopher S. Lynch — 36,427; (vii) Linda A. Mills — 30,913; (viii) Thomas F. Motamed — 28,498; (ix) Peter R. Porrino — 30,695; (x) John G. Rice — 5,146; (xi) Amy L. Schioldager — 16,324; (xii) Douglas M. Steenland — 39,623; and (xiii) Therese M. Vaughan — 19,520.

(4) This amount includes charitable contributions disbursed by AIG during 2022 under AIG’s Matching Grants Program, through which AIG provides a two-for-one match on charitable donations in an amount of up to $10,000 annually per independent director. For Mr. Lynch and Ms. Schioldager, the amount also includes a total of $93,550 in cash retainer fees paid to each of them for their service, commencing November 2, 2021, as directors of Corebridge

Financial, Inc.

(5)Messrs. Fitzpatrick and Lynch, and Ms. Schioldager did not stand for election at the 2022 Annual Meeting.

26AIG 2023 PROXY STATEMENT

Corporate Governance Shareholder Engagement

Shareholder EngagementAudit Committee

Fostering long-term relationships with our shareholders | | | | | |

MEMBERS Peter R. Porrino, Chair W. Don Cornwell Linda A. Mills John G. Rice

7 MEETINGS HELD IN 2022 | PRIMARY RESPONSIBILITIES nAssists the Board in its oversight of AIG’s financial statements, including internal control over financial reporting nReviews and discusses with senior management the guidelines and policies by which AIG assesses and manages the Company's exposures to risk nCoordinates with the Chair of the Risk and Capital Committee to help each committee receive the information it needs to carry out its responsibilities with respect to oversight of risk assessment and risk management nAssists the Board in its oversight of the qualifications, independence and performance of AIG’s independent registered public accounting firm, including responsibility for the appointment, compensation, retention and oversight of the firm's work nAssists the Board in its oversight of the performance of AIG’s internal audit function, including responsibility for the appointment, replacement, reassignment or dismissal of, and being involved in the performance reviews of, AIG’s chief internal auditor nAssists the Board in its oversight of AIG’s compliance with regulatory requirements, including reviewing periodically with management any significant legal, compliance and regulatory matters that have arisen or that may have a material impact on AIG’s business, financial statements or compliance policies, AIG’s relations with regulators and governmental agencies and any material reports or inquiries from regulators and government agencies nApproves regular, periodic cash dividends on AIG common stock and preferred stock consistent with Board-approved dividend policies and with support from the Risk and Capital Committee to confirm the adequacy of AIG’s capital and liquidity |

|

The Board has determined, on the recommendation of the NCGC, that (i) each member of the Audit Committee (Messrs. Porrino, Cornwell and maintaining their trustRice, and Ms. Mills) is a priority forfinancially literate and has accounting or related financial management expertise under the Board. Engagement with shareholders helps us gain useful feedback on a wide variety of topics, including corporate governance, executive compensation, corporate social responsibility, business strategyNYSE's listing standards and performance(ii) Messrs. Porrino, Cornwell and related matters. Shareholder feedback also helpsRice are “audit committee financial experts” as that term is defined in better tailoring the public information provided to address the interestsSecurities and inquiries of shareholders.

Accordingly, AIG has long maintained an active, ongoing dialogue with shareholders and other stakeholders. As part of this process, the Independent Chairman and the Chief Executive Officer periodically participate in meetings with shareholders to discuss and obtain feedback on a variety of matters. Topics covered in these

Exchange Commission's (SEC) rules.

![[MISSING IMAGE: tv489104_frontcover.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_frontcover.jpg)

![[MISSING IMAGE: lg_aig-folio.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/lg_aig-folio.jpg)

![[MISSING IMAGE: tv489104_chrt-pie1.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_chrt-pie1.jpg)

![[MISSING IMAGE: tv489104_chrt-pie2.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_chrt-pie2.jpg)

![[MISSING IMAGE: ph_don-cornwellph.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_don-cornwellph.jpg)

![[MISSING IMAGE: ph_brian-duperreault.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_brian-duperreault.jpg)

![[MISSING IMAGE: ph_john-fitzpatrick.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_john-fitzpatrick.jpg)

![[MISSING IMAGE: ph_william-jurgensen.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_william-jurgensen.jpg)

![[MISSING IMAGE: ph_chris-lynch.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_chris-lynch.jpg)

![[MISSING IMAGE: ph_henry-miller.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_henry-miller.jpg)

![[MISSING IMAGE: ph_linda-mills.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_linda-mills.jpg)

![[MISSING IMAGE: ph_nora-johnson.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_nora-johnson.jpg)

![[MISSING IMAGE: ph_ronald-rittenmeyer.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_ronald-rittenmeyer.jpg)

![[MISSING IMAGE: ph_doug-steenland.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_doug-steenland.jpg)

![[MISSING IMAGE: ph_theresa-stone.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/ph_theresa-stone.jpg)

![[MISSING IMAGE: tv489104_chrt-pie3.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_chrt-pie3.jpg)

![[MISSING IMAGE: tv489104_table1.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_table1.jpg)

![[MISSING IMAGE: tv489104_table2.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_table2.jpg)

![[MISSING IMAGE: tv489104_backcover.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_backcover.jpg)

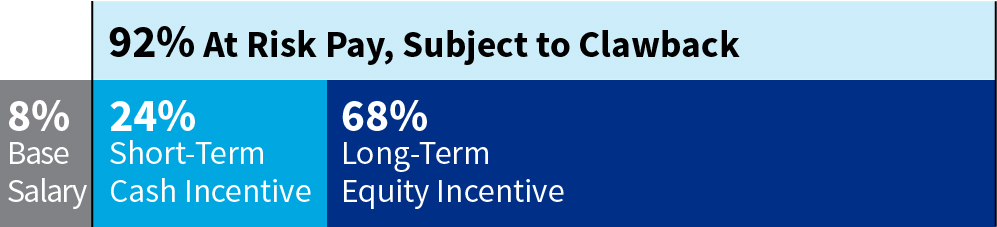

![[MISSING IMAGE: tv489104_pc1.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_pc1.jpg)

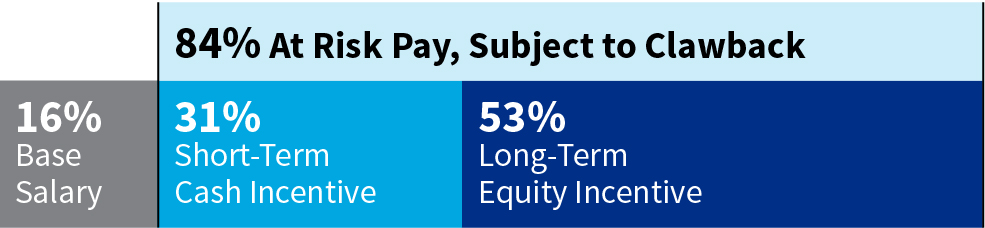

![[MISSING IMAGE: tv489104_pc2.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_pc2.jpg)

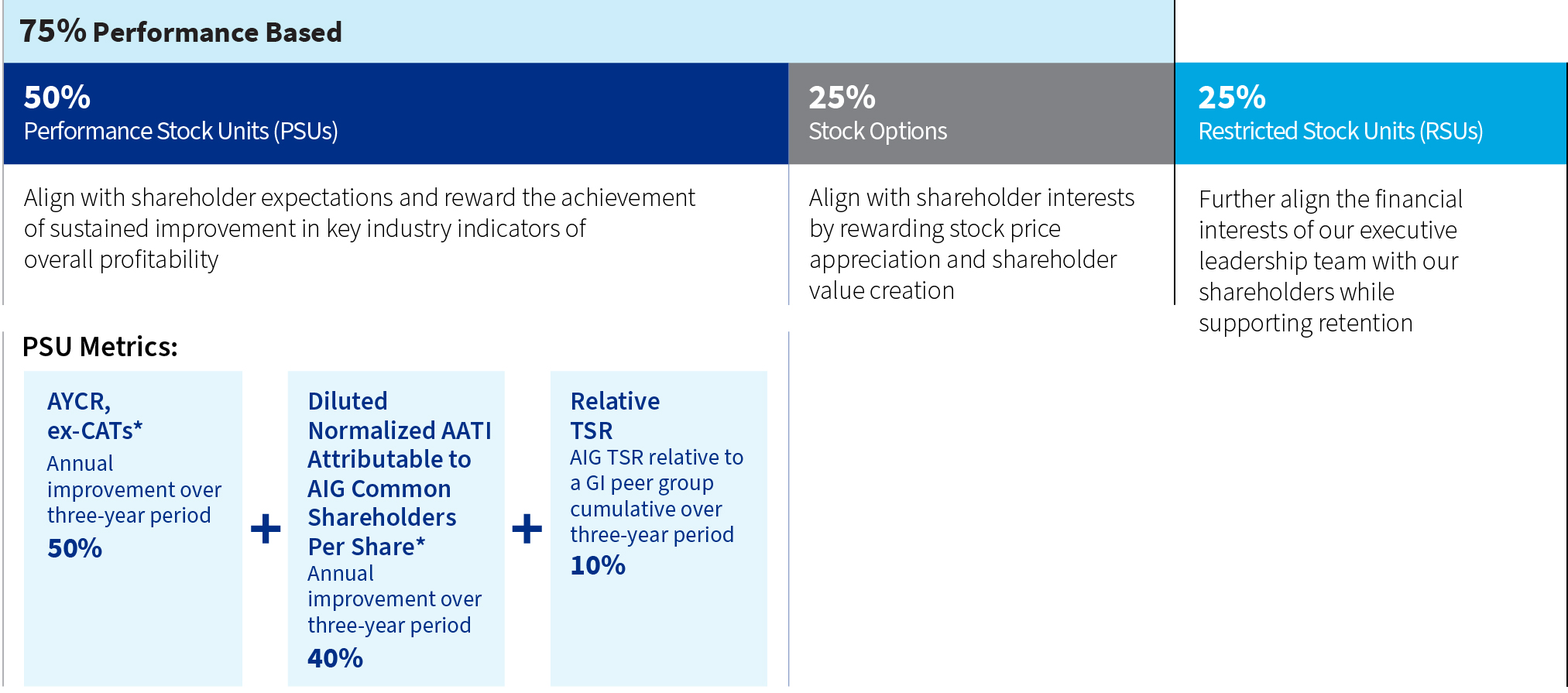

![[MISSING IMAGE: tv489104_na1.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_na1.jpg)

![[MISSING IMAGE: tv489104_na2.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_na2.jpg)

![[MISSING IMAGE: tv489104_na3.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_na3.jpg)

![[MISSING IMAGE: tv489104_na4.jpg]](https://capedge.com/proxy/DEF 14A/0001571049-18-000196/tv489104_na4.jpg)